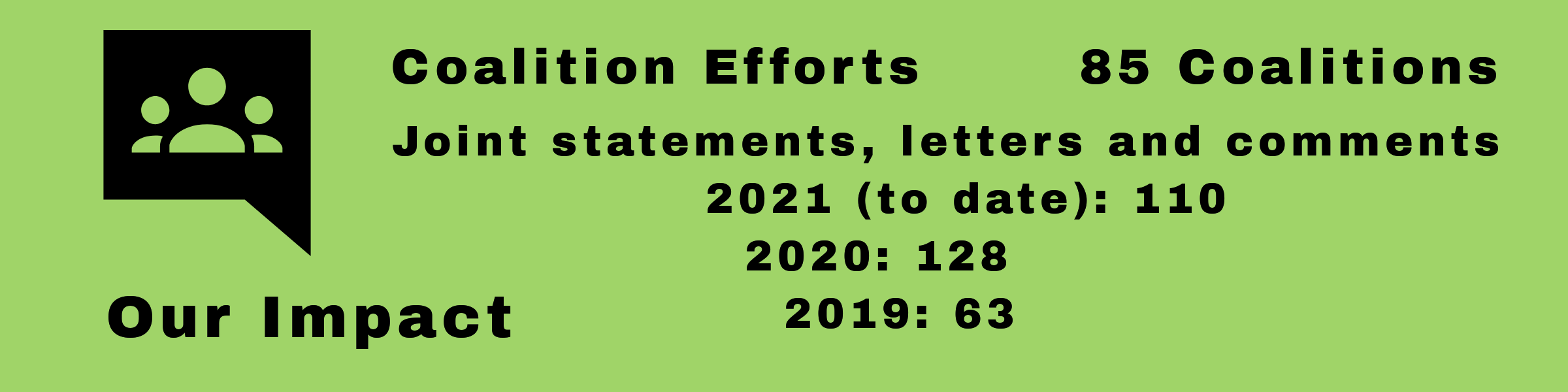

Coalition Efforts

Consumer Action is working on these important issues along with other organizations. If you would like to know more about these issues, please see “More Information” at the end of each article.

Table of Contents

Postings

Legislation would curb abusive “trigger leads”—unwanted home financing offers to mortgage borrowers

Diverse groups signed on to letter supporting the Homebuyers Privacy Protection Act of 2024, which would curb the abusive use of mortgage credit “trigger leads”—the sale of consumer data that results in a bombardment of calls seeking to lure them from their chosen lenders.

52 advocacy groups endorse FTC’s ban on junk fees

Consumer Action was part of a broad coalition of advocacy organizations that voiced support for the FTC’s proposed rulemaking on junk fees, which would ban hidden and misleading fees across the economy.

FHFA should require new homes financed with Fannie/Freddie-backed mortgages to meet energy code requirements

More than 75 organizations urged the FHFA to require that all new homes purchased with mortgages backed by Fannie Mae and Freddie Mac meet updated energy code requirements.

Groups tell FTC that Americans want the right to repair their stuff

Consumer Action was one of the organizations to sign a letter to the FTC urging the agency to take steps to remove manufacturer restrictions that make it harder and more expensive for consumers to repair their phones, laptops and tablets.

Call for SEC to ban mandatory arbitration agreements

Consumer Action joined allies in a letter to the SEC chairman asking the agency to issue a rulemaking banning the use of mandatory pre-dispute arbitration agreements in investment adviser and broker-dealer contracts.

Endorsement for INSURE Act, to address crisis in home insurance market

Advocates expressed support for the Incorporating National Support for Unprecedented Risks and Emergencies (INSURE) Act, which would create a federal catastrophic reinsurance program to insulate consumers from unrestrained homeowners insurance cost increases.

DOL’s proposed rule would expand fiduciary requirement for those providing investment advice

Dozens of organizations signed on to a letter to the Department of Labor expressing support for the agency’s proposed rule that would provide comprehensive protections for consumers who turn to professional advisors for retirement investment advice.

Consumer Action supports bill to ban hedge fund ownership of residential housing

Consumer Action is a supporter of the End Hedge Fund Control of American Homes Act of 2023, which would address an urgent issue that has made it more difficult for middle-class Americans to become homeowners and is contribution to America’s twin crises of housing unaffordability and wealth inequality.

CFPB should disregard request to delay planned Fair Credit Reporting Act rulemaking

Sixty groups wrote to CFPB Director Chopra urging him to disregard a request by industry trade organizations to delay the agency’s planned Fair Credit Reporting Act (FCRA) rulemaking by issuing an Advanced Notice of Proposed Rulemaking—a unnecessary delay that would allow industry abuses to continue in the interim.

Opposition to Earned Wage Access Consumer Protection Act

More than a hundred advocacy groups wrote to U.S. Representative Bryan Steil, author of the draft Earned Wage Access Consumer Protection Act, to voice their opposition to the bill because its true effect would be to exempt FinTech companies and payday lenders from regulations designed to protect consumers.