Released: April 01, 2014

Consumer Action INSIDER - April 2014

Table of Contents

- What people are saying

- Did you know?

- New guide to insurance for home-based microbusinesses

- Hotline assisted with plethora of issues in 2013

- Hotline Chronicles: Switching electricity suppliers might cost you

- Got milk? Staff member responds ‘yes’ to save ‘preemies’

- Good credit in Filipinotown

- Policy Buzz: Proposed ‘gainful employment’ regulations fall short

- Money magazine features Consumer Action outreach manager

- Visiting Camp Pendleton for Military Saves Week

- Young Women CAN! manage money

- About Consumer Action

What people are saying

The Cooperative Extension Program and Holding Institute Community Center in Laredo is collaborating with a wonderful contact from your MoneyWi$e training last year—the Goodwill Good Choices Portal of San Antonio. Yeah! — Crisanta Mussett, Cooperative Extension Program, Prairie View A&M University, Laredo, TX

Did you know?

You may be able to use Free File at IRS.gov to prepare and e-file your federal tax return online for free. The majority of taxpayers are eligible for Free File because their income was $58,000 or less in 2013. The Internal Revenue Service partners with a number of online tax preparation companies, including TurboTax, TaxSlayer and H&R Block among others. These programs guide you through tax preparation with a series of questions. You also can prepare your own tax returns and file them for free using Free Fillable Forms, which does the math but doesn't help you figure out deductions, etc. Learn more.

New guide to insurance for home-based microbusinesses

For the entrepreneur engaged in creating a microbusiness, insurance coverage might not be at the top of the priority list, but it should be. Protecting yourself and your assets is a fundamental part of any business plan.

Whether it’s handmade crafts, landscaping or freelance consulting, consumers with low-budget, home-based businesses need insurance coverage to provide a safety net in case of theft, accidents, lawsuits and other unexpected events.

“Many home-based business owners believe mistakenly that a homeowners (or renters) policy will protect them from all manner of misfortune,” said Linda Sherry, director of national priorities for Consumer Action. “The reality is that the typical microbusiness owner needs more coverage for adequate protection.”

Consumer Action took a close look at what additional insurance the home-based entrepreneur or microbusiness owner would need.

- In-home or home-based business policies typically provide coverage for loss or damage to equipment and records as well as loss of income from certain unexpected events.

- Business owner’s policies (BOPs) offer comprehensive coverage, such as liability protection for accidents that occur on or off premises, and often include medical coverage.

- Professional liability insurance (errors and omissions) covers the cost of mistakes when advising or providing client services.

As soon as a microbusiness hires its first employee, workers’ compensation and unemployment insurance are usually required. These policies provide medical benefits and/or wage replacement when an employee is injured on the job or is fired or laid off. Coverage requirements vary widely by state.

Many factors affect a business’s insurance needs, including the type of work you do, where you do it and the specific items you are trying to protect, such as equipment, data, inventory, etc. Consumer Action’s research finds it is vital for small business owners to assess their needs, risks and potential liabilities.

The findings and recommendations, tips and practical advice are contained in the Spring 2014 issue of Consumer Action News, the organization’s quarterly newsletter.

Hotline assisted with plethora of issues in 2013

Last year, Consumer Action’s free referral and advice hotline responded to 6,839 complaints and other communications via phone and email or webmail. The top categories were product/retail (28%), utility/telephone (16%), credit/finance (13%) and automotive (11%). About one-third of the complaints we received fall under a mix of other categories.

Consumers from all states and the District of Columbia reached out to our hotline in 2013. The largest number of complaints by state was received from California consumers (1,663). Other significant states were New York (598), Florida (584), Texas (349) and New Jersey (230).

Our multilingual hotline counselors served mostly English-speaking consumers (86%), with other languages spoken being Spanish (3%), Cantonese (5%) and Mandarin (2%). For approximately 4 percent of complaints, no language was noted.

Most people told us they had found Consumer Action on the Internet (62%).

Each month in the INSIDER, we feature the “Hotline Chronicles,” a series based on consumer complaints to our hotline. Click here for a collection of past articles.

If you’d like to contact our hotline team with a complaint, click here to submit it online (in English) (en español), or call 415-777-9635 and leave a voicemail message in English, Spanish or Chinese (Mandarin and Cantonese dialects).

Hotline Chronicles: Switching electricity suppliers might cost you

Calvin* from Pennsylvania contacted our hotline to complain about sales tactics by a deregulated electricity provider. “They told me that I would receive about a 10 percent lower bill because they could supply my utility with cheaper power and that would reduce my bill,” he told Consumer Action.

In deregulated electric markets, consumers can choose their electricity “supplier.” The legacy state-regulated utility (power company) remains responsible for “distributing” power to households. When you switch suppliers, your bill contains separate charges from the supplier and the distributor. If you remain with your state regulated power company, it is both the supplier and the distributor.

According to OpenSecrets.org, among the 24 states that have enacted electricity deregulation plans, results are mixed. Complaints like Calvin’s are not uncommon. Rising prices, skyrocketing demand and limited supply in some areas have raised questions about the viability of deregulation.

Door-to-door salespeople from the competitive power supplier visited Calvin’s home and convinced him to use their company to supply his electricity. (Competitive power suppliers also use telemarketing calls to sell their services.)

The visiting salespeople promised Calvin big discounts from his current bill. Before he agreed to move to the “competitive energy provider,” Calvin got his power from the state-regulated utility and was billed around $40 per month, which included a charge of about $20 for distribution. After Calvin switched, his first bill was for about $100 for supply and about $20 for distribution.

Consumer Action’s counselors advised Calvin that he could switch back to the utility for supply. As far as the higher bill, we suggested that he call and ask for a refund. However, Calvin said he had done so and that the competitive power supplier wouldn’t budge. We suggested that he contact his state’s public utility commission (PUC) and the Better Business Bureau (BBB) to lodge a complaint of unfair and deceptive marketing tactics. To locate your state PUC, visit the National Association of State Regulatory Commissioners. To find your local BBB chapter, visit the Council of Better Business Bureaus and use its locator map.

Before making a switch:

- Review recent statements. Check bills from your local utility or current competitive supplier so that you know how much you’ve been paying.

- Research competitive suppliers. Only consider companies that are well established and licensed in your state. Type the name of the company into a search engine and look for complaints by other consumers. Check BBB ratings as well.

- Taxes and additional charges. Ask if the price includes a state sales tax or any other taxes, charges or fees.

- Ask for a guarantee. Get rate reduction promises in writing—or walk away. You’ll probably be told that no one can predict the cost of electricity supply, but that answer is proof that the salespeople can’t promise specific discounts.

*Not this consumer’s real name.

Got milk? Staff member responds ‘yes’ to save ‘preemies’

Every day, Consumer Action staff members embrace important causes, from protecting individual privacy and consumer rights to promoting fair lending practices and keeping homeowners in their homes. But it’s not every day that their efforts, quite literally, save lives—very young ones, at that.

In December 2012, Nani Hansen, an associate director in Consumer Action’s San Francisco office, and her husband welcomed baby daughter Rylie to the family. This time around, Hansen decided to see a lactation consultant to overcome feeding problems she had encountered with son Daniel a few years before. During these consultations, she learned about an organization called Mother’s Milk Bank.

Mother’s Milk Bank, based in San Jose, CA, was established in 1974 in response to the need for donor milk to feed premature infants who are allergic to formula and whose mothers are unable to nurse them. The FDA-registered non-profit provides prescription donor human milk to 93 hospitals and hundreds of families in 13 states. In 2013, they distributed over 570,000 ounces of donor milk to preterm infants and children unable to digest other sources of nutrition.

Having experienced her own nursing challenges, Hansen felt compelled to help. Before committing, however, she put her best “savvy consumer” skills to work by researching Mother’s Milk Bank and other milk donor programs. What she found is that Mother’s Milk Bank, a member of the Human Milk Banking Association of North America's network of non-profit milk banks, charges families only $3.75-$4.50 per ounce to cover the processing of the milk, which includes pasteurization. And they help families file the health insurance claims. At least one other program Hansen looked into takes donated milk and sells it to an affiliated for-profit company, which charges many times the non-profit price per ounce or converts it into a human milk-based fortifier that can cost hundreds of dollars per bottle.

“Just like in other areas of life, we have to be careful of our choices,” said Hansen.

After finishing her research, Hansen completed the Mother’s Milk Bank’s donor screening requirements, which include an interview, lab tests and medical history check. She has donated to the bank since May 2013, but that will be ending soon.

“I would encourage other mothers to do this. It is really rewarding to know that I’m not wasting something that is beneficial for others,” said Hansen. “I feel really blessed and I want to share it. It’s nice to support another mother and take the pressure off her for a while.”

In February, the Mother’s Milk Bank asked donors and recipients to share three heartfelt reasons why they love donor milk. All responses were entered in a Valentine’s Day drawing, which Hansen won. Her response, along with photos of Rylie and mom, was featured in the organization’s March newsletter.

The demand continues to rise for breast milk, which provides critical antibodies and anti-bacterial benefits to infants. To become a milk donor, call 877-375-6645 or visit Mother’s Milk Bank’s website.

Good credit in Filipinotown

The non-profit Search to Involve Pilipino Americans (SIPA) is a long-time partner in Consumer Action’s network of community-based organizations. In February, the group invited Consumer Action’s Nelson Santiago to be part of its eight-session entrepreneurial training program.

Anna Marie Cruz, a small business specialist at SIPA, asked Santiago to present the MoneyWi$e “Building and Keeping Good Credit” module to a group of about 25 entrepreneurs enrolled in the program offered by SIPA’s Small Business Development Program. SIPA’s program provides training to local entrepreneurs and small business owners on starting businesses and on expanding and improving existing businesses. Cruz sought Consumer Action’s participation citing the importance of helping entrepreneurs build the best possible personal credit history so that they can eventually access credit for their businesses.

Consumer Action’s MoneyWi$e modules are created in partnership with Capital One Bank. Santiago, who regularly presents the MoneyWi$e credit module at train-the-trainer meetings around the country, welcomed the opportunity to present to SIPA’s clients a few miles west of downtown Los Angeles, in the heart of historic Filipinotown.

“Small business owners and entrepreneurs are often among the audiences most eager to learn about credit,” Santiago explained. The group attending the SIPA workshop was engaged and eager to learn about the topics covered, from the best way to obtain credit reports to avoiding scams that promise quick credit fixes. During the hour and a half workshop, Santiago not only covered the substantive material but also gave attendees a chance to test their credit knowledge in a competitive and interactive activity. (The free MoneyWi$e curricula include many interactive classroom activities.)

After the workshop, Santiago remarked on the great feedback—and appreciation—from participants. “Attendees received lots of information and resources, and based on the applause and cheers at the conclusion of the workshop, I think they had fun too.” Aside from the thanks, Santiago said that the turkey sandwich and potato chips that SIPA packed for him to take home after the late evening workshop also said “Thank you” in a really big way.

Policy Buzz: Proposed ‘gainful employment’ regulations fall short

The Obama Administration’s Department of Education released its draft “gainful employment” regulation for career education programs on March 17. The draft regulations would cover career education programs, including for-profit colleges, and would also impact career education programs at traditional two- and four-year colleges. The proposed standards would require covered programs to fully disclose costs, debt levels and employment outcomes, and would require the programs to meet accreditation as well as professional licensing requirements.

Consumer Action partner The Institute for College Access and Success says, however, that the “rule does nothing to help students hurt by shoddy career-education programs that leave tens of thousands of students in the worst of all positions—with big debt and no degree, or with big debt and a worthless credential.”

Rory O’Sullivan, policy and research director at Young Invincibles and the lead student negotiator during the 2013 negotiated rulemaking, said, “We’re deeply disappointed that, rather than strengthen the prior draft, the Department weakened protections for students in several ways. Most disturbingly, it completely eliminated financial debt relief for students who attended failing programs.”

According to The Leadership Conference on Civil and Human Rights, for-profit colleges are responsible for close to half of all loan defaults and 31 percent of all student loans, but only about 13 percent of the total student population.

Consumer Action’s Linda Sherry visited the Office of Budget & Management in late February to urge the release of a strong draft rule. “Unscrupulous schools are recruiting students for expensive programs that do not train or certify them for jobs,” said Sherry. “Often such programs offer so little support that students drop-out, still owing loans. We cannot continue allowing students to take on huge debt without the means to repay the loans, or to burden taxpayers with millions of dollars in defaulted student loans.”

The majority of vocational program students who end up saddled with debt but unable to get a good job are women, minorities, low-income individuals, veterans and servicemembers. “Greater regulation is needed to hold these schools accountable for the rising tide of debt and the default rates by students enrolled in these for-profit programs,” said Sherry.

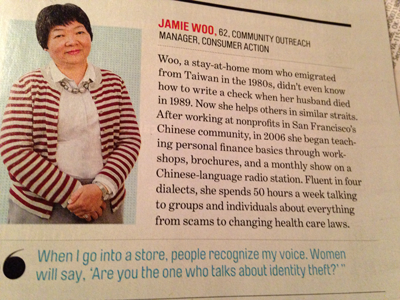

Money magazine features Consumer Action outreach manager

She can’t leap tall buildings in a single bound or see through walls using X-ray vision, but Consumer Action community outreach manager Jamie Woo is still a hero. At least that’s how her coworkers, San Francisco Bay Area non-profits, Chinese immigrants and Money magazine see her.

In December, the national print and online personal finance publication recognized Woo as a hero for her work helping newcomers learn about the American banking system, choose and use financial products wisely, make smart consumer choices, avoid scams and understand their consumer rights. (Read the article.)

Jamie Woo of Consumer Action was featured in Money Magazine for her outreach and consumer education work in the Chinese community

A typical week for Woo includes leading educational workshops in the Chinese-American community, participating in community events, preparing press releases and consumer alerts, and being interviewed for in-language media.

Fluent in four dialects, Woo also translates Consumer Action’s publications and website content and screens any Chinese publications we use for accuracy.

During one of her recent monthly shows on Sing Tao Chinese radio station KVTO (1400 AM), Woo talked about the Target data breach and gave listeners tips for spotting and dealing with identity theft.

Woo joined Consumer Action’s outreach and training department in 2006. As a Taiwanese immigrant in the 1980s, she didn’t know much about personal finance in the States—not even how to write a check, as the Money article points out. Her transformation into an expert on personal finance and consumer rights, despite the numerous challenges she faced, makes Woo a uniquely inspirational teacher to monolingual and limited-English-speaking Chinese newcomers.

“I was a new immigrant too, and after seven years I hadn’t learned too much before I lost my husband and became a single mother. I faced challenges every day…now I’m sharing my knowledge and experience,” explained Woo. “The Chinese newcomer community trusts me, and without a language barrier, they sometimes even share their own experiences by calling my radio show.”

Woo says she keeps abreast of consumer issues in the Chinese community by reading, listening and watching, because you never know when you’ll be asked to educate the community at a moment’s notice. Such was the case a few weeks ago, when several travel agencies in San Francisco’s Chinatown and the Bay Area mysteriously closed, leaving customers with worthless airline tickets and vacation packages. Local Chinese media outlets immediately turned to Woo to provide information and advice to their audiences. (Read our alert.)

Eight years after joining Consumer Action, Woo is still as committed as ever to her mission and her community. “Time flies, but you keep learning and facing new challenges. The people in Chinatown look at me and smile…at the grocery store, they tell me they learn a lot,” says Woo. “I feel good about that.”

Visiting Camp Pendleton for Military Saves Week

As February drew to a close, Consumer Action joined the Department of Defense’s Financial Readiness Campaign at the launch of its annual Military Saves week, held at the Camp Pendleton Marine Corps Base in San Diego, CA.

The Military Saves program encourages servicemembers and their families to save money, reduce debt and build wealth by offering them relevant and timely financial education.

For the second year, Consumer Action’s community outreach and training manager Linda Williams was invited to give a presentation at the base to mark Military Saves Week. Williams, the proud mother of a marine who is currently stationed at Camp Pendleton, seized the opportunity to discuss the very timely topic of data breaches, just as the public was beginning to learn more about the massive data breach at Target.

Staff Sgt. Jameel L. Taylor—son of Consumer Action’s community outreach and training manager Linda Williams—peruses publications at the Military Saves Week event.

Williams talked about different forms of ID theft such as financial, medical and criminal, and explained how being a victim of a data breach increases a person’s vulnerability to identity fraud.

Using Consumer Action’s newly revised MoneyWi$e identity (ID) theft module, Williams stressed the importance of regularly checking one’s credit and specialty consumer reports, adding that a fraudulent credit history, even one resulting from ID theft, could endanger a servicemember’s security clearance. She told participants that recent reports indicate that more than 13 million people were victims of fraud in 2013, with account takeover fraud accounting for 28 percent of all ID fraud.

The 2014 Identity Fraud study released by Javelin Strategy & Research also reported that consumers whose Social Security numbers were compromised in a data breach incident were five times more likely to become victims of fraud than all other consumers, and 14 times more likely to become a victim of “new account” fraud.

Williams told the audience to pay close attention to any notifications or letters they receive from financial institutions, including credit card providers and retailers, especially if they receive a notice that their personally identifiable information was stolen. She advised those who become victims of a data breach to consider accepting free credit monitoring services and, if there is a possibility that their Social Security numbers were compromised, to consider placing security freezes on their credit reports.

A credit freeze is one of the strongest ways to guard against ID theft after a breach because it blocks a credit report from being accessed by potential creditors, thwarting scammers who may be trying to get credit in your name. Consumer Action, NCLA and U.S. PIRG created an alert with steps to take for victims of a data breach. Click here to read the alert.

Young Women CAN! manage money

In early March, a member of Consumer Action’s outreach team participated in the Young Women CAN! Event hosted by Congresswoman Jackie Speier (D-CA) for high school girls ages 14-18 at Facebook’s Menlo Park corporate campus. The event was designed to teach young women about science, technology, engineering and math (STEM) education, modes of “empowering communication,” and financial education. More than 150 students and parents attended.

“This century is about STEM jobs,” Speier said. “Young women must recognize where opportunities exist for their futures. Today, we ignited enthusiasm in them for STEM careers.” The Congresswomen and the keynote speaker, Dr. Natalie Batalha, a research astronomer in the Space Science Division of NASA Ames Research Center and a member of the Kepler Mission, made a compelling case for why young women should consider STEM careers.

After the general session, the students had the opportunity to attend one of three workshops. Techbridge, an organization working to inspire girls to discover a passion for technology, science and engineering, facilitated “STEM Inspired.” MoneyWi$e Teens and Money was facilitated by Consumer Action’s Audrey Perrott, and “Empowering Communication” was led by Equal Rights Advocates, a group fighting for equality for women and girls.

High school students and some parents attended the Teens and Money session. Perrott provided a condensed training that started with impressing upon the students the importance of savings, making sound financial decisions and tracking their expenses. Perrott had the audience do a “sit down” exercise, where she had the entire class stand up and then sit down if a particular statement relating to banking, savings, tracking expenses or establishing credit resonated with them. The exercise engaged the audience and determined which topics were of greatest interest.

Next, Perrott asked the class if they knew how banks and credit unions differ. Perrott discussed the key differences and similarities between banks and credit unions and discussed the advantages of having an account rather than obtaining financial services from check cashing outlets, payday lenders, etc.

When Perrott asked the class if they knew the difference between wants and needs, one student correctly indicated that needs could include food, housing and transportation. Another student—also correctly—suggested that examples of wants were fast food, clothing and make-up.

Dividing the class and assigning team leaders for each table, Perrott led students in the Needs vs. Wants activity from the Teens and Money lesson plan. The students considered different items and images representing needs versus wants. The kids found alternatives such as taking public transportation or walking as an alternative to driving, or watching YouTube videos for free instead of buying CDs or concert tickets.

Using our “Monica and Sarah” activity from the MoneyWiSe Teens and Money lesson plan, the students gauged sound choices and offered recommendations for saving money.

The students had a lot of budgeting savvy. One student shared questions that she asks herself before major purchases: 1) Will I want this item in five days? 2) Will I want it in five months? 3) Will I need it in five years? If she can’t answer “yes” to all three questions, she said she doesn’t make the purchase.

Perrott concluded the session with a discussion about credit. She told the students that it was important to establish and maintain good credit. Having bad credit could have a negative impact on their ability to obtain housing, employment, education loans, buy cars or obtain good rates for insurance, credit cards, etc. Perrott issued each class participant a “Teens and Money” booklet, a calculator and a financial literacy game so that they would continue to school themselves in financial literacy.

About Consumer Action

Consumer Action is a non-profit 501(c)(3) organization that has championed the rights of underrepresented consumers nationwide since 1971. Throughout its history, the organization has dedicated its resources to promoting financial and consumer literacy and advocating for consumer rights in both the media and before lawmakers to promote economic justice for all. With the resources and infrastructure to reach millions of consumers, Consumer Action is one of the most recognized, effective and trusted consumer organizations in the nation.

Consumer education. To empower consumers to assert their rights in the marketplace, Consumer Action provides a range of educational resources. The organization’s extensive library of free publications offers in-depth information on many topics related to personal money management, housing, insurance and privacy, while its hotline provides non-legal advice and referrals. At Consumer-Action.org, visitors have instant access to important consumer news, downloadable materials, an online “help desk,” the Take Action advocacy database and nine topic-specific subsites. Consumer Action also publishes unbiased surveys of financial and consumer services that expose excessive prices and anti-consumer practices to help consumers make informed buying choices and elicit change from big business.

Community outreach. With a special focus on serving low- and moderate-income and limited-English-speaking consumers, Consumer Action maintains strong ties to a national network of nearly 7,500 community-based organizations. Outreach services include training and free mailings of financial and consumer education materials in many languages, including English, Spanish, Chinese, Korean and Vietnamese. Consumer Action’s network is the largest and most diverse of its kind.

Advocacy. Consumer Action is deeply committed to ensuring that underrepresented consumers are represented in the national media and in front of lawmakers. The organization promotes pro-consumer policy, regulation and legislation by taking positions on dozens of bills at the state and national levels and submitting comments and testimony on a host of consumer protection issues. Additionally, its diverse staff provides the media with expert commentary on key consumer issues supported by solid data and victim testimony.