Prepping for success

Kelly Armstrong wants to help change the lives of young inner-city men. Knowing that one in six black males between 15 and 25 are out of school, out of work or incarcerated, Armstrong took these dismal statistics as a challenge when she founded Primed & Prepped, a hospitality management and culinary arts mentoring and job training program at the Bayview YMCA in San Francisco.

Armstrong, a longtime community financial educator who has attended many Consumer Action train-the-trainer events, invited Consumer Action’s Audrey Perrott to present some financial literacy basics to the young participants at Primed & Prepped. Armstrong, director of the program she founded, said Perrott offered “a fantastic presentation on money management for teens. It was insightful and really had the students thinking about money and how they spend it.”

Perrott presented excerpts from the MoneyWi$e Teens & Money module and engaged the students in interactive activities. She discussed wants versus needs, setting and prioritizing financial goals, tracking one’s spending, and the difference between gross and net pay. After introducing the benefits of banks and credit unions, she discussed selecting a financial institution, opening an account and controlling banking costs.

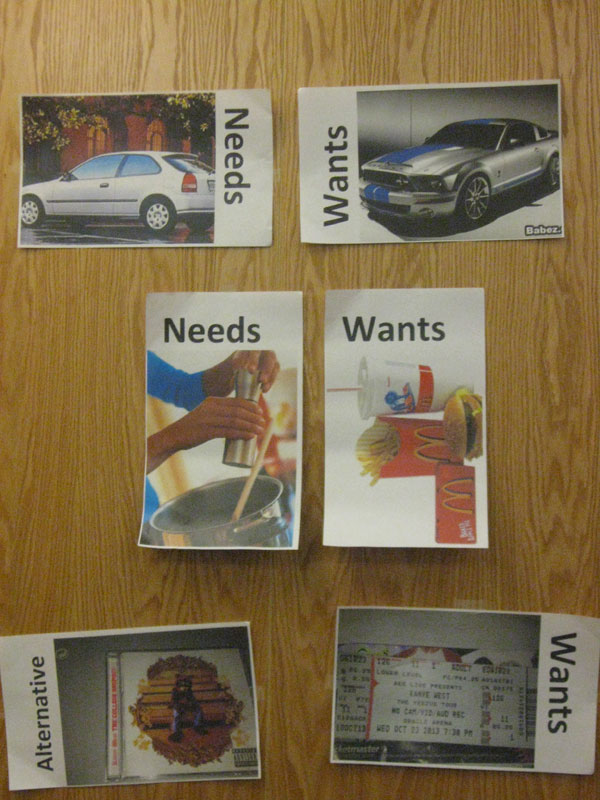

To illustrate these concepts, Perrott posted photos of “wants, needs and alternatives” and invited the students to discuss the images. “I asked them to help determine why I had flagged certain things as "wants” as opposed to needs,” said Perrott.

Exploring more reasonable—or free—alternatives to their “wants,” Perrott asked the students to think outside the box. She suggested free concerts, community movie nights and going to the library to read magazines and check out books, music and movies, etc. The young men suggested bringing one's lunch, walking (or taking public transit) instead of driving and playing sports as a form of entertainment and exercise.

Because most of the students will soon be seeking their first jobs, Perrott led the class through an activity in the Teens & Money module called “Jamal’s First Paycheck”. She followed up with the module’s “Check Writing Activity.” “Most of the students were unbanked,” noted Perrott. “The exercise empowered them for the near future, when they are wage earners and account holders.”

Perrott noted that many of the young men in the program are saving money but do not have an established relationship with a financial institution yet. Using the “Monica and Sara” exercise, she led the group in an examination of the fictional girls’ spending and saving habits. “The exercise was a good way for the kids to consider how extravagant spending can lead to financial ruin.” As the young people joined in the discussion, Perrott rewarded their participation with financial education games designed for teens.

At the end of the training, Perrott held a drawing for a $5 lunch gift card and shared ways for students to manage the costs of eating out by ordering water instead of a soft drink, using a coupon to purchase a meal or ordering the “daily special.”

For more about Primed & Prepped, read Armstrong’s blog. All Consumer Action educational training modules can be found on our Modules page.